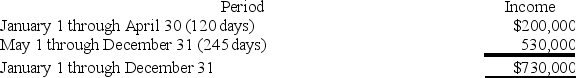

ABC was formed as a calendar-year S corporation with Alan, Brenda and Conner as equal shareholders. On May 1, 2018, ABC's S election was terminated after Conner sold his ABC shares (one-third of all shares) to his solely owned C corporation Conner, Inc. ABC reported business income for 2018 as follows (assume that there are 365 days in the year):

If ABC uses the daily method of allocating income between the S corporation short tax year (January 1 - April 30) and the C corporation short tax year (May 1 − December 31), how much income will it report on its S corporation short tax year return and its C corporation short tax year return for 2018?

Definitions:

Stressor Defense

Strategies or mechanisms adopted by an individual or system to protect against stress or stress-induced conditions.

Developmental Variable

A factor that undergoes change over time and influences the growth or development of an individual or system.

Optimal Wellness

A state of complete physical, mental, and social well-being, not merely the absence of disease or infirmity, where an individual or group achieves a balance of health habits, mental stability, and social happiness.

System Variables

Components or factors within a system that can change and affect the system's behavior and outcomes.

Q14: A salesperson should be familiar with his

Q16: The built-in gains tax does not apply

Q37: MWC is a C corporation that uses

Q57: Packard Corporation transferred its 100 percent interest

Q66: Tristan transfers property with a tax basis

Q72: Lamont is a 100% owner of JKL

Q76: Which of the following is a True

Q85: Gordon operates the Tennis Pro Shop in

Q88: This year, HPLC, LLC was formed by

Q90: Which of the following is a True