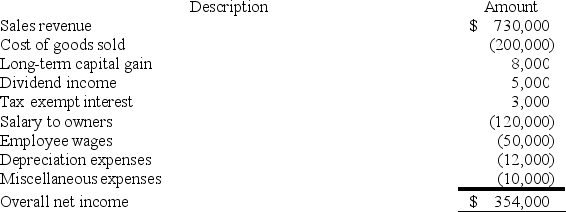

XYZ Corporation (an S corporation) is owned by Jane and Rebecca who are each 50% shareholders. At the beginning of the year, Jane's basis in her XYZ stock was $40,000. XYZ reported the following tax information for 2018.

Required:

a. What amount of ordinary business income is allocated to Jane?

b. What is the amount and character of separately stated items allocated to Jane?

c. What is Jane's basis in her XYZ corp. stock at the end of the year?

Definitions:

Outpatient Levels

Degrees or types of medical or psychiatric care provided to patients who visit a healthcare facility but do not require admission to a hospital.

Quadrants of Care

A framework in health care that categorizes types of services provided into four parts to address the varying needs of patients.

Psychiatric Disorders

Mental health conditions characterized by alterations in thinking, mood, or behavior associated with distress or impaired functioning.

SUDs

Substance Use Disorders, a condition characterized by the excessive use of substances, including alcohol and drugs, leading to significant impairment or distress.

Q5: The nonselling activities on which most salespeople

Q6: Jimmy Johnson, a U.S. citizen, is employed

Q7: Daniel acquires a 30% interest in the

Q30: Businesses must collect sales tax only in

Q43: Most services are sourced to the state

Q66: Which of the following is not a

Q70: The term "outside basis" refers to the

Q75: Tyson, a one-quarter partner in the TF

Q95: Clampett, Inc. converted to an S corporation

Q102: After terminating or voluntarily revoking S corporation