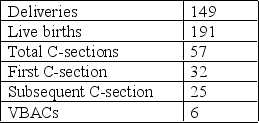

-Refer to above figure :Calculate the C-section rate:

Definitions:

Employment Request

An application or submission made by an individual seeking to obtain a position of employment in a company or organization.

Positive Handling

An approach that focuses on constructive and encouraging methods to manage or interact with people or situations.

Vacancies

Open or unoccupied positions or spaces, often referring to job openings.

Positive Emphasis

The practice of focusing on positive aspects or outcomes in communication to achieve a desired response.

Q1: What is the discipline of diagnosing, preventing,

Q12: E-commerce and e-business systems blur together at

Q12: Refer to above figure :Calculate the infant

Q14: If a data analyst is asked to

Q27: A constraint that restricts a data field

Q33: The stage of labor during which the

Q39: The purpose of the Human Genome Project

Q52: Joe and Jane desperately want to have

Q62: Label K: _

Q87: Label G: _