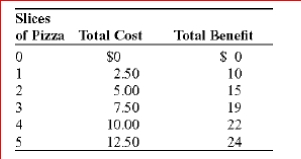

You can buy slices of pizza at $2.50 each, and you have created a table that summarizes your total cost and total benefit of purchasing up to five slices of pizza.A coworker, looking over your shoulder, says that you should consume five slices of pizza because the total benefit you receive is greatest at that quantity.How do you respond? Is there any situation in which your coworker might be correct?

Definitions:

Personal Casualty Losses

are financial losses resulting from the damage, destruction, or loss of personal property from sudden, unexpected, or unusual events.

Deductibility

The ability of a taxpayer to subtract certain expenses or contributions from their gross income, reducing the amount of taxable income.

Casualty Deduction

A tax deduction for losses incurred from the sudden, unexpected, or unusual destruction of property.

Personal Casualty Losses

Financial losses resulting from the damage, destruction, or loss of personal property from events like natural disasters, theft, or accidents, which may be deductible under certain conditions.

Q20: When a decision maker chooses the option

Q25: _ is a way of breaking a

Q30: Suppose Joan buys a new refrigerator to

Q96: If a tax system is designed to

Q104: If tax efficiency is the only goal,

Q122: If the United States removed the tariffs

Q157: Scenario: Accounting and Economic Profit<br>Rather than put

Q180: Figure: Marginal Benefits and Marginal Costs<br>(Figure: Marginal

Q181: Expenses associated with factors of production may

Q267: To minimize deadweight loss, markets where demand