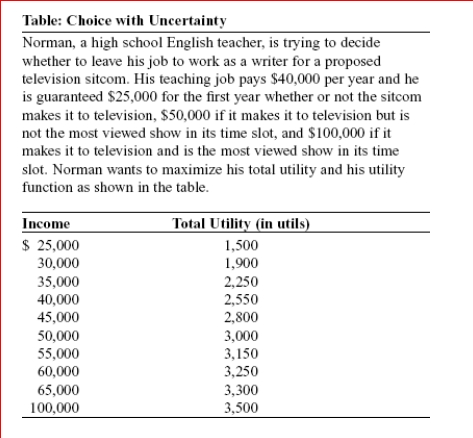

(Table: Choice with Uncertainty) Look at the table Choice with Uncertainty.Suppose the probability that the sitcom does not make it to television is 30%, that it makes it to television but is not the most viewed show in its time slot is 50%, and that it makes it to television and is the most viewed show in its time slot is 20%.Given this information, Norman, as a utility maximizer:

(Table: Choice with Uncertainty) Look at the table Choice with Uncertainty.Suppose the probability that the sitcom does not make it to television is 30%, that it makes it to television but is not the most viewed show in its time slot is 50%, and that it makes it to television and is the most viewed show in its time slot is 20%.Given this information, Norman, as a utility maximizer:

Definitions:

T-bill

Short-term government securities that mature in a year or less, offering investors a safe and liquid means of investment.

Capital Allocation Line

A line on a graph that represents the risk-return trade-off of investments, showing the rates of return for efficient portfolios depending on the risk-free rate and the market risk.

Standard Deviation

A statistical measure of the dispersion or variability of a set of data points from their mean, used in finance to gauge the volatility of investment returns.

Expected Rate

The anticipated return on an investment, taking into account various factors like market trends, risk level, and past performance.

Q11: The price of microchips used to produce

Q19: The premium on insurance is often to

Q23: Figure: The Gains from Trade<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1063/.jpg"

Q66: (Table: Competitive Market for Good Z) Look

Q74: The ability-to-pay principle is a good justification

Q81: Scenario: Used Car Market In the used

Q103: How have advancements in medicine contributed to

Q138: The quantity demanded of labor will decrease

Q146: (Table: Workers and Corn Output) Laura is

Q150: A situation in which purchases do not