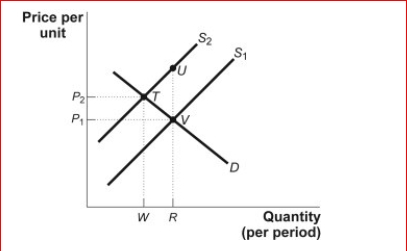

Figure: Correcting for Market Failure

(Figure: Correcting for Market Failure) Assume that there is an external cost involved in the

(Figure: Correcting for Market Failure) Assume that there is an external cost involved in the

Market illustrated in the figure Correcting for Market Failure.If the government intervenes to correct for the external cost, the new ________ will now reflect _.

Definitions:

FIFO Method

The FIFO (First-In, First-Out) method is an inventory valuation strategy where the costs of the oldest inventory items are assigned to the cost of goods sold first.

Inventory Item

An item stored within a company's inventory that is ready or will be ready for sale, including raw materials, work-in-progress, and finished goods.

Gross Profit Method

A technique used in accounting to estimate the amount of ending inventory and cost of goods sold by applying a gross profit margin to sales.

Ending Inventory

The value of goods available for sale at the end of an accounting period, calculated as the beginning inventory plus purchases minus cost of goods sold.

Q17: If externalities are fully internalized, an outcome

Q44: DeVonda owns a music store.One night, vandals

Q47: Figure: Market Failure <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1063/.jpg" alt="Figure: Market

Q61: Poverty programs are aimed at:<br>A)keeping people from

Q63: (Table: Value of the Marginal Product of

Q91: Given the general agreement that pollution is

Q101: Figure: Equilibrium in the Labor Market <img

Q104: Since talking while driving generates a negative

Q108: Employment-based insurance:<br>A)is provided by companies to their

Q134: Benny employs people to sell candy bars