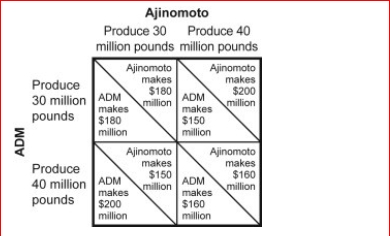

Figure: Payoff Matrix for Ajinomoto and ADM

(Figure: Payoff Matrix for Ajinomoto and ADM) Given the payoff matrix in the figure Payoff Matrix for Ajinomoto and ADM, the optimal combination for maximum combined profit occurs when:

(Figure: Payoff Matrix for Ajinomoto and ADM) Given the payoff matrix in the figure Payoff Matrix for Ajinomoto and ADM, the optimal combination for maximum combined profit occurs when:

Definitions:

Pension Expense

The cost to a company for maintaining a defined benefit pension plan, including service cost, interest cost, expected return on plan assets, and any amortization of past service costs.

Pension Funding

The process of accumulating financial resources to cover obligations for pension plans, ensuring funds are available for retirement benefits.

Accumulated Benefit Obligation

The actuarial present value of all future pension benefits earned to date, based on current salary levels, without assuming future salary increases.

Pension Liability

The financial obligation a company has to provide its employees with pension benefits, representing the difference between the total amount due to retirees and the amount of funds the company has set aside to cover these costs.

Q21: When an activity like education generates a

Q23: A monopolistically competitive industry, such as corn

Q32: In the long run, monopolistic competitors will:<br>A)earn

Q46: Figure: Positive Externalities and the Production of

Q59: Which of the following is a necessary

Q124: If a good that involves external costs

Q141: Some politicians are pushing for development of

Q176: (Table: Demand Schedule for Gadgets) Look at

Q200: If large fixed costs result in ATC

Q313: If a perfectly competitive firm is producing