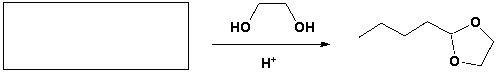

The starting material that completes the following reaction is

Definitions:

Deductible

The amount that a taxpayer must pay out-of-pocket before an insurance company will pay any expenses.

Unreimbursed Employee Business Expenses

Expenses employees incur in the course of performing their job that are not reimbursed by the employer.

Itemized Deductions

Expenses allowed by the IRS that can be subtracted from adjusted gross income to reduce taxable income, including mortgage interest, medical expenses, and charitable contributions.

2% Floor

A tax rule that limits the deductibility of certain miscellaneous expenses to only the portion that exceeds 2% of the taxpayer’s adjusted gross income.

Q7: <span class="ql-formula" data-value="\beta"><span class="katex"><span class="katex-mathml"><math xmlns="http://www.w3.org/1998/Math/MathML"><semantics><mrow><mi>β</mi></mrow><annotation encoding="application/x-tex">\beta</annotation></semantics></math></span><span

Q8: Carboxylic acids and amides have in general

Q18: How do DNA and RNA differ?<br>I. the

Q28: The reagent needed to complete the following

Q28: When one mole of sodium bicarbonate is

Q29: Glutamic acid has an isoelectric point of

Q37: Stearic acid is an unsaturated fatty acid.

Q46: 4-(2-hydroxyethyl)-1-methylcyclohexanol reacts with HBr (gas) in dioxane

Q49: Arrange the compounds in order of increasing

Q53: The structure of the tripeptide Glu-Gly-Phe is