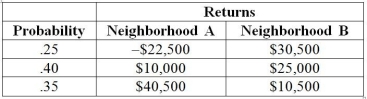

TABLE 5-7

There are two houses with almost identical characteristics available for investment in two different neighborhoods with drastically different demographic composition. The anticipated gain in value when the houses are sold in 10 years has the following probability distribution:

-Referring to Table 5-7, if you can invest 10% of your money on the house in neighborhood A and the remaining on the house in neighborhood B, what is the portfolio expected return of your investment?

Definitions:

Real GDP

The total market value of all final goods and services produced in a country in a given year, adjusted for inflation.

Constant Returns To Scale

The property whereby long-run average total cost stays the same as the quantity of output changes.

Inputs

Factors including workforce, materials, and funds employed in the process of creating products or offering services.

Production

The process of combining various material inputs and immaterial inputs (plans, know-how) to make something for consumption.

Q37: The amount of bleach a machine pours

Q43: The difference between the upper limit of

Q76: A company has 2 machines that produce

Q91: Which of the following is sensitive to

Q98: An investment consultant is recommending a certain

Q106: Referring to Table 4-10, what is the

Q109: Referring to Table 4-9, if a randomly

Q112: The probability that house sales will increase

Q177: Referring to Table 6-2, for a given

Q184: Suppose that past history shows that 6%