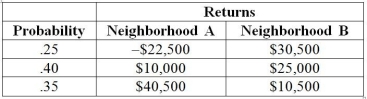

TABLE 5-7

There are two houses with almost identical characteristics available for investment in two different neighborhoods with drastically different demographic composition. The anticipated gain in value when the houses are sold in 10 years has the following probability distribution:

-Referring to Table 5-7, if your investment preference is to maximize your expected return and not worry at all about the risk that you have to take, will you choose a portfolio that will consist of 10%, 30%, 50%, 70%, or 90% of your money on the house in neighborhood A and the remaining on the house in neighborhood B?

Definitions:

Income Taxes

Taxes imposed by governments on the income generated by businesses and individuals within their jurisdiction.

Income Tax Expense

The total amount of income tax a company is obligated to pay to the government, reported as an expense in the income statement.

Income Tax Rate

The percentage at which an individual or corporation is taxed on their income, which can vary based on income level, jurisdiction, and other factors.

After-Tax Discount Rate

A discount rate that has been adjusted for the effect of taxes, utilized in evaluating the net present value (NPV) of an investment after taxes.

Q26: Referring to Table 6-5, what is the

Q62: Referring to Table 4-1, given that alcohol

Q76: Referring to Table 3-2, the third quartile

Q96: Referring to Table 5-1, the probability that

Q116: Referring to Table 3-7, what is the

Q118: Suppose Z has a standard normal distribution

Q134: A debate team of 4 members for

Q136: Referring to Table 3-1, what type of

Q165: Assume that house prices in a neighborhood

Q173: Referring to Table 5-1, the probability that