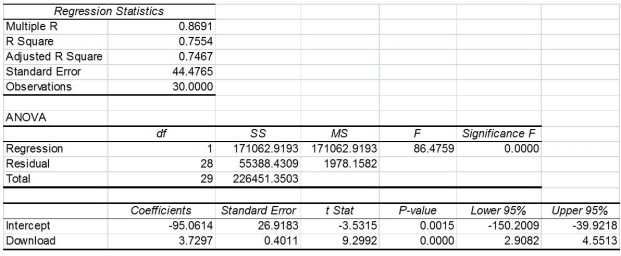

TABLE 13-11

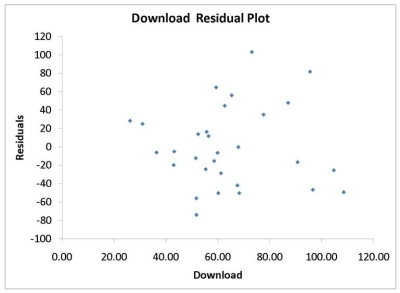

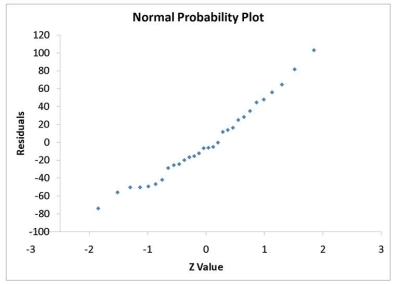

A computer software developer would like to use the number of downloads (in thousands) for the trial version of his new shareware to predict the amount of revenue (in thousands of dollars) he can make on the full version of the new shareware. Following is the output from a simple linear regression along with the residual plot and normal probability plot obtained from a data set of 30 different sharewares that he has developed:

-Referring to Table 13-11, what is the p-value for testing whether there is a linear relationship between revenue and the number of downloads at a 5% level of significance?

Definitions:

Capital Asset Pricing Model

The Capital Asset Pricing Model (CAPM) is a model that describes the relationship between systematic risk and expected return for assets, particularly stocks.

Nondiversifiable Risk

Risk that cannot be eliminated by investing in many projects or by holding the stocks of many companies.

Diversifiable Risk

Risk that can be eliminated either by investing in many projects or by holding the stocks of many companies.

Expected Return

Expected return is the anticipated profit or loss from an investment, factoring in all possible outcomes weighted by their probabilities.

Q19: Referring to Table 15-3, suppose the chemist

Q24: Referring to Table 14-15, the null hypothesis

Q25: When using the X² tests for independence,

Q45: Referring to Table 11-6, the decision made

Q122: When r = -1, it indicates a

Q128: Referring to 14-16, the 0 to 60

Q188: Referring to Table 12-12, if the null

Q192: Referring to Table 14-18, there is not

Q213: Referring to Table 14-7, the department head

Q247: Referring to Table 14-19, what is the