The following information concerning Sherwood Ltd.has been made available for the development of cash and other budget information for the months of July, August, and September.

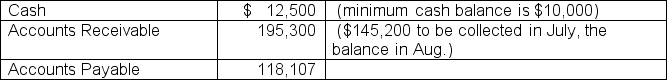

Selected balances at July 1st are expected to be:

The budget is to be based on the following assumptions:

Sixty percent (60.0%)of the billings are collected in the month of the sale; 25% are collected in the month following the sale; 10% are collected in the 2nd month following the sale and 5% are estimated to be uncollectible

Fifty-five percent (55.0%)of all product purchases are paid for in the month purchased, with the remaining 45% paid in the month following the purchase.Each unit of product costs $22.

Selling, general and administrative expenses, of which $2,000 is depreciation, are equal to 25% of the current month's sales dollar.These expenses are paid for in the month incurred.

The Board of Directors of Sherwood Ltd.has declared a cash dividend totaling $75,000 that is to be paid in August.

Sherwood Ltd.has a considerable investment portfolio that provides investment income each month of $12,500.

Sherwood Ltd.is required to pay an installment on their current year's income tax assessment in July.The amount due is $12,000.

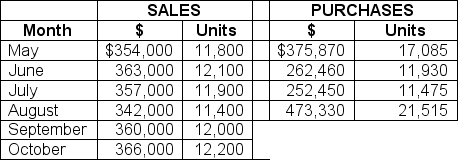

Actual and projected sales and purchases are as follows:

Prepare a cash budget for the months of July and August, including a cash receipts and cash disbursements schedule.

Definitions:

Laboratory Science

The field of science that focuses on experiments and analyses conducted in controlled environments, such as labs, to understand natural phenomena or develop new technologies.

Physics

The natural science that studies matter, its motion and behavior through space and time, and the related entities of energy and force.

Zoology

Zoology is the branch of biology that studies animals, their physiology, structure, genetics, behavior, classification, and distribution.

Sociology

The study of social behavior, organization, and patterns of human interaction within societal contexts.

Q13: The <img src="https://d2lvgg3v3hfg70.cloudfront.net/SM6477/.jpg" alt="The of

Q15: Make a list of the computer companies

Q21: Toronto Skaters Company has a D/E ratio

Q31: As part of your job hunting activities,

Q36: Product pages at e-commerce sites with URLs

Q44: Give examples of time shifting, place shifting,

Q46: The section of a program that contains

Q47: A(n) <img src="https://d2lvgg3v3hfg70.cloudfront.net/SM6477/.jpg" alt="A(n) is

Q47: Executive managers typically engage in <img src="https://d2lvgg3v3hfg70.cloudfront.net/SM6477/.jpg"

Q83: Which of the following is another term