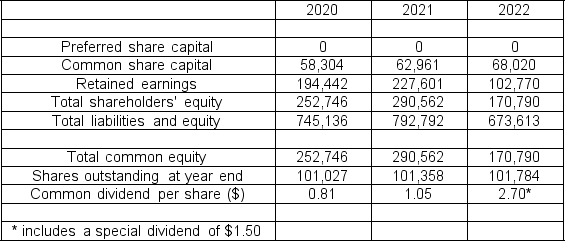

You are given the following shareholders' equity figures for Toronto Skaters Inc.(TS) for the fiscal year ends of 2020, 2021, and 2022.What is TS's book value per share for each of the three years, beginning with 2020?

Definitions:

Markowitz Model

A portfolio optimization theory that demonstrates how to achieve the best portfolio allocation to maximize return for a given level of risk through diversification.

Systematic Risk

The risk inherent to the entire market or entire market segment, which cannot be eliminated through diversification.

Index Model

A model that describes the relationship between the returns of a stock and the returns of a market index.

Covariance

A measure of the degree to which two variables move in relation to each other, with a positive covariance indicating that they tend to move in the same direction.

Q15: Using your own examples, discuss the ways

Q16: Capital expenditures are<br>A)a firm's investments in net

Q27: A firm is evaluated using the liquidation

Q28: A stock dividend differs from a stock

Q28: Can trade credit be labelled as a

Q34: A prospectus is mandatory for all securities

Q44: A project will cost $50,000 to initiate

Q47: McGill Inc.is considering adopting a new credit

Q54: If the current credit policy is 3/30

Q58: The level of a firm's investment in