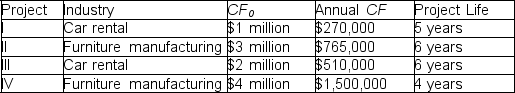

Northwest Territories Holding Corporation is comprised of two different divisions: car rental and furniture manufacturing.Two-thirds of the company's business comes from the furniture manufacturing division and the balance from the car rental division.The WACC for the car rental division is 9% and for the furniture manufacturing division is 15%.What would happen if the company used the overall WACC in the valuation of the following independent projects?

Definitions:

Regressive

A characteristic of a tax system where the tax rate decreases as the taxable amount increases.

Tax Cuts

Reductions in the amount of taxes imposed by a government on its citizens, often aimed at stimulating economic growth or achieving specific policy objectives.

Progressive Taxes

Taxation that takes a larger percentage of income from high-income earners than from low-income earners, aimed at reducing income inequality.

Ability-To-Pay Principle

The concept that taxes should be levied according to an individual's or entity's ability to bear them, typically resulting in higher earners paying more taxes.

Q1: You are the manager of a sales

Q4: Which of the following is NOT one

Q5: Use the following statements to answer this

Q6: Find the forward price for one forward

Q12: La Montrealaise Transportation Company is considering a

Q20: Generally, initial public offerings (IPOs)are:<br>A)fairly priced.<br>B)overpriced.<br>C)underpriced.

Q20: Determine the required rate of return on

Q26: Which of the following actions precedes a

Q27: Which of the following is NOT a

Q69: Use the following three statements to answer