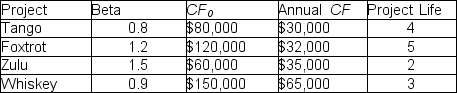

Toronto Skaters Corporation (TSC) has no budget constraint on new investments.The risk-free rate is 2% and the market risk premium is 6%.What rate of return (discount rate) should TSC use to evaluate the Zulu project?

Definitions:

Required Return

Required return is the minimum gain an investor expects to achieve from an investment, accounting for the risk level compared to the return of a risk-free asset.

Risk-Free Rate

The return on investment with no loss of principal, often represented by the yield on government securities.

Beta

An indicator that determines the systematic risk or volatility of a security or a portfolio relative to the overall market.

Portfolio Beta

A measure of the volatility, or systematic risk, of a portfolio in comparison to the market as a whole.

Q15: When an acquiring firm bypasses current management

Q16: The following equation represents the:<br>A)Present value of

Q20: Risk-Return in a Portfolio Question:<br>The following table

Q20: You are the manager of a sales

Q21: Which one of the following can be

Q49: MacLean Inc.currently pays no dividends.Today, the firm

Q55: Queue de Castor Foods is considering the

Q72: Charlotte purchased a common share for $50

Q80: Abitibi Pulp Ltd.is considering a new

Q115: Min has $5,000 to invest.The expected return