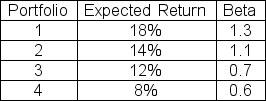

The expected return on the market is 14% with a standard deviation of 18% and the risk-free rate is 5%.Which of the following portfolios are underpriced?

Definitions:

Expected ROE

The anticipated return on equity, calculated based on expected future earnings divided by shareholders' equity.

Expected ROE

The projected return on equity, which measures a company's efficiency at generating profits from every unit of shareholder's equity.

Dividend Growth Rate

The annualized percentage rate of growth that a particular stock's dividend undergoes over a period of time.

Plowback Ratio

The proportion of earnings retained by a company after dividends have been paid out, often used to fund growth projects.

Q6: Toronto Skates Inc.is offering a dividend of

Q10: Which one of the following is NOT

Q15: Carmen's grandfather died five years ago and

Q18: Suppose your friend came to see you

Q28: Which one of the following will increase

Q31: Given the following information:<br> <span class="ql-formula"

Q38: By definition LIBOR is:<br>A)the long-term inter-bank option

Q39: The expected return on the market is

Q59: Which of the following is (are)useful in

Q92: By combining the risk-free asset and the