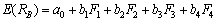

Suppose the returns on Security B are linearly related to four risk factors: F1, F2, F3, and F4.The required rate of return on Security B can be determined as follows:  .The risk-free rate is 5%.What is the risk premium for F4, if the required return of Security B is 20%, b1, b2, b3, and b4 are 0.5, 0.7, 0.6, and 0.9, respectively, and F1, F2, and F3 are 4.25%, 5.75%, and 6.5%, respectively?

.The risk-free rate is 5%.What is the risk premium for F4, if the required return of Security B is 20%, b1, b2, b3, and b4 are 0.5, 0.7, 0.6, and 0.9, respectively, and F1, F2, and F3 are 4.25%, 5.75%, and 6.5%, respectively?

Definitions:

Zygomaticus Major

A facial muscle that draws the mouth upward and outward, playing a key role in expressing smiling.

Buccinator

A muscle of the cheek that acts to compress the cheek against the teeth and is used in blowing and chewing.

Carpal Tunnel Pressure

The pressure within the carpal tunnel, an anatomical compartment of the hand, potentially leading to carpal tunnel syndrome when increased.

Palmar Aponeurosis

A thick fibrous tissue layer in the palm of the hand that anchors the skin and helps in gripping.

Q6: Which of the following is the best

Q10: Profit from a short position in a

Q24: Use the following statements to answer this

Q34: Prices of securities trading on The Grenadines

Q48: A portfolio is composed of $2,000 invested

Q53: Use the following three statements to answer

Q62: Which of the following is true when

Q74: Which one of the following is a

Q78: The risk-free rate is 4.5%.The expected return

Q79: Which of the following is a FALSE