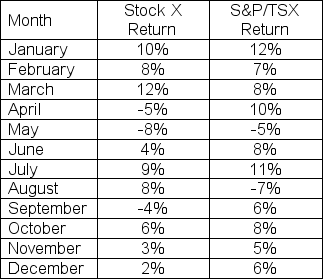

Given the following information:

a)What are the average monthly returns on Stock X and the S&P TSX?

b)What are the standard deviations of the monthly returns on Stock X and the S&P TSX?

c)What is the covariance of the returns on Stock X and the S&P TSX?

d)What is the beta of Stock X?

e)What is the implied risk-free rate?

Definitions:

Common Stock

A type of security signifying ownership in a corporation and entitling the holder to a share of the company's profits, essentially a mode of holding equity in the corporation.

Dividend Growth Model

A method used to value a company's stock by using predicted dividends and factoring in the growth rate of the dividends.

Required Rate of Return

The lowest yearly percent gain anticipated by an investor from investing in a specific asset.

Preferred Stock Dividends

Dividends that are paid to holders of preferred shares, typically at a fixed rate and before any dividends are paid to common shareholders.

Q8: A proposed ten-year project has the first

Q10: How much should a monthly compounded account

Q11: What is the yield of a 91-day

Q24: If an investor is trying to cancel

Q27: An exchange of an interest rate return

Q33: Explain the term "yield to maturity."

Q43: Suppose you observed that five-year government bonds

Q64: Use the following two statements to answer

Q71: Given the following information, what is the

Q92: Capital rationing may be used as an