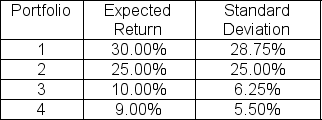

The expected return on the market is 15% with a standard deviation of 12.5% and the risk-free rate is 5%.Which of the following portfolios are correctly priced?

Definitions:

Incremental Cash Flows

The additional cash flow a new project generates for an organization, which is critical for assessing its viability and profitability.

Opportunity Costs

The price paid for not selecting the next most favorable choice when a decision is made.

Asset Replacement

The process of substituting old assets with new ones to maintain or improve operational efficiency.

Asset Expansion

The process of increasing a company's investment in current and fixed assets to boost its capacity and efficiency.

Q5: VIX can be used<br>A)to price interest rate

Q7: A "fixed for floating" interest rate swap

Q27: What is the yield-to-maturity (YTM)of a four-year

Q36: Suppose you are given the following information

Q49: What condition is necessary to create a

Q50: Suppose a firm has just reported an

Q50: If an asset becomes fully depreciated for

Q55: A firm has a budget constraint of

Q71: Which of the following class(es)of ratios examines

Q87: Which of the following are NOT components