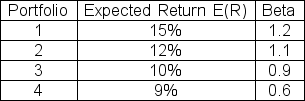

The expected return on the market is 12% with a standard deviation of 16% and the risk-free rate is 4.5%.Which of the following portfolios are overpriced?

Definitions:

Incremental Cash Flows

The net additional cash flows generated by a company as a result of taking on a new project or investment.

Leasing vs. Buying

A comparative analysis between renting an asset for a certain period and purchasing the asset outright, each with its own financial implications.

Lessor's Tax Rate

The tax rate applicable to the income earned from leasing assets or property by the lessor.

Q10: Which one of the following is NOT

Q17: On January 1, you forecasted that there

Q20: What is the difference between a liquidity

Q43: Consider an investment opportunity that requires an

Q58: Which of the following is NOT a

Q79: The expected return of a portfolio on

Q80: The current stock price of Bay James

Q90: How much would you pay for a

Q111: Suppose a seven-year project requires an initial

Q112: Stock A has a standard deviation of