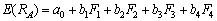

Suppose the returns on Security A are linearly related to four risk factors: F1, F2, F3, and F4.The required rate of return on Security A can be determined as follows:  .The risk-free rate is 4.5%.What is the required rate of return of Security A, where b1, b2, b3, and b4 are 0.4, 0.8, 0.6, and 0.7, respectively, and F1, F2, F3, and F4 are 5%, 6%, 10%, and 8%, respectively?

.The risk-free rate is 4.5%.What is the required rate of return of Security A, where b1, b2, b3, and b4 are 0.4, 0.8, 0.6, and 0.7, respectively, and F1, F2, F3, and F4 are 5%, 6%, 10%, and 8%, respectively?

Definitions:

Normally Distributed

A type of continuous probability distribution characterized by a symmetrical, bell-shaped curve, where the mean, median, and mode are all equal.

Standard Deviation

A measure of the dispersion or variability in a set of values, indicating how much individual values deviate from the mean.

Fish Market

A marketplace where fish and seafood are traded, often involving auctioning and retail sales, catering to consumers and businesses.

Normally Distributed

Outlines a probability distribution characterized by symmetry around the mean, illustrating that data points in close proximity to the mean occur more often than data points far away from the mean.

Q16: Which of the following strategies does NOT

Q39: Suppose you own a portfolio that has

Q40: The standard Black-Scholes option pricing model applies

Q41: A Credit default swap is classified as:<br>A)an

Q43: Igor the intern has obtained the following

Q56: Genie would like to receive an exact

Q56: BC Travel Services is considering a new

Q66: A 5-year bond with a 10% coupon

Q71: The market yield on a 12-year 8%

Q79: The expected return of a portfolio on