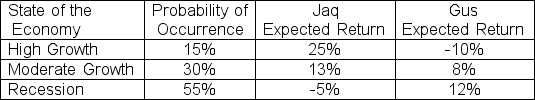

Cinderella plans to form a portfolio with two securities: Jaq and Gus.The correlation between the two securities is -1.Given the following forecasts, what are the weights in Jaq and Gus that will set the standard deviation of the portfolio equal to zero?

Definitions:

Maturity Date

The specific date on which the principal amount of a debt instrument, such as a bond or loan, becomes due and payable.

Allowance for Doubtful Accounts

A contra-asset account that reduces the total accounts receivable balance to reflect accounts that are expected not to be collected.

Bad Debt Expense

An expense recognized when receivables are no longer collectible due to customer default.

Prompt Payment

A term describing the timely processing of payment to a vendor or creditor, often governed by contractual terms or regulations to ensure payments are made within an agreed-upon timeframe.

Q10: Use the following three statements to answer

Q23: Which of the following is (are)true about

Q35: Which of the following is TRUE?<br>A)Interest expenses

Q37: BC Corporation has just paid a dividend

Q50: You purchased shares of a company in

Q74: What is the yield-to-maturity (YTM)of a four-year

Q86: What is the IRR of a project

Q90: How much would you pay for a

Q91: Which of the following is a FALSE

Q111: The risk adjusted discount rate (RADR)is:<br>A)the firm's