Risk-Return in a Portfolio Question:

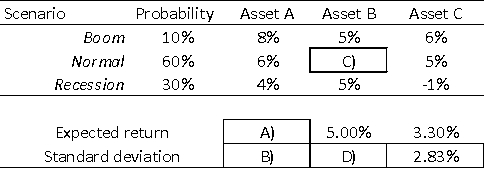

The following table presents some statistics about the returns of three assets, Assets A, B, and C, respectively, under three possible scenarios (Boom, Normal, and Recession).The expected probabilities of each state are also specified in the table.

a)Complete the blanks in the above table.Show your calculations.

b)Suppose you wish to combine Assets A and B in order to create a portfolio that has the same total risk as Asset C.What weight should you invest in Asset A? In Asset B?

Definitions:

Rascally

Describing behavior that is playfully mischievous or dishonest, often in a benign or amusing way.

Rabbits

Small mammals with long ears, characterized by their fast reproduction and commonly found in several parts of the world.

Proposition

A declaration that signifies an opinion or judgment.

Contrary Propositions

Statements that cannot both be true at the same time, though they can both be false.

Q9: Use these statements to answer the following

Q9: Connie bought 400 shares of ABC Company

Q12: Eloise has deposited $2,000 in an investment

Q19: Which of the following businesses is most

Q34: Why did the book to market ratio

Q45: Suppose the spot exchange rate is C$.75

Q52: You have received two job offers:<br>ABC is

Q80: Use the following statements to answer the

Q90: Igor the intern has obtained the following

Q113: What improvement does MIRR represent over traditional