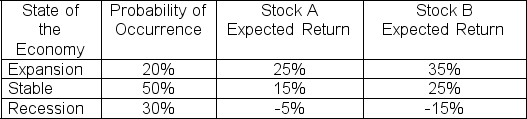

Given the following forecasts, what is the expected return for a portfolio that has $1,500 invested in Stock A and $4,500 invested in Stock B?

Definitions:

Gym Visits

A count of the number of times an individual attends a gym or fitness center within a specified period.

Standard Deviation

A measure of the amount of variation or dispersion in a set of values, indicating how spread out the values are from the mean.

Poisson Random Variable

Represents the number of events occurring within a fixed interval of time or space, assuming these events happen at a constant rate and independently of the time since the last event.

Expected Value

The expected value is the long-run average value of repetitions of an experiment it represents, often used in probability and statistics.

Q6: An investment pays $1,000 per year for

Q7: Which of the following best defines a

Q27: What is the yield-to-maturity (YTM)of a four-year

Q31: Suppose the Canadian Space Agency has two

Q35: You made an investment in your RRSP

Q45: Which of the following are classified as

Q48: Indiana Jones intends to form a portfolio

Q57: You are the CFO of a major,

Q69: Use the following three statements to answer

Q104: Vancouver Salmon Farm Inc.'s current operations will