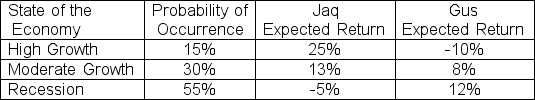

Cinderella plans to form a portfolio with two securities: Jaq and Gus.The correlation between the two securities is -1.Given the following forecasts, what are the weights in Jaq and Gus that will set the standard deviation of the portfolio equal to zero?

Definitions:

Alternative Dispute Resolution Act

Legislation that promotes the use of alternative methods, such as mediation or arbitration, for resolving disputes outside of traditional court proceedings.

Federal District Courts

Courts of the United States that deal with both civil and criminal cases under federal law. They are the trial courts of the federal court system.

Litigants

Individuals or parties involved in a lawsuit.

Binding Agreement

A legally enforceable contract or agreement between two or more parties with clearly defined terms.

Q1: Forward contracts:<br>A)trade in an open market.<br>B)establish a

Q11: Which of the following is NOT a

Q34: Consider a project that would change the

Q38: By definition LIBOR is:<br>A)the long-term inter-bank option

Q55: At the beginning of the year a

Q60: The expected return on the market is

Q61: Which of the following is NOT true?<br>A)The

Q81: Suppose a firm has just reported an

Q84: Junkies Corporation has just paid a dividend

Q139: Toronto Skaters Corporation has no budget constraint