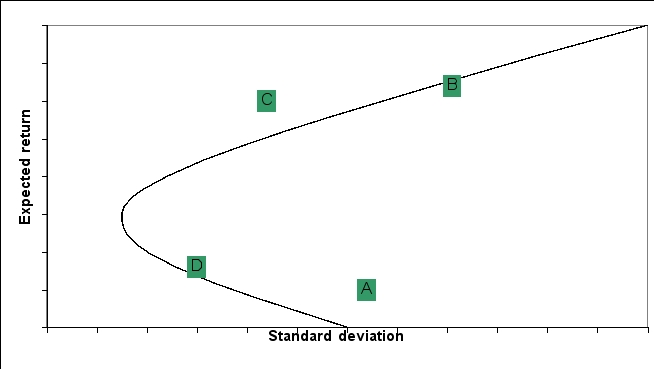

The standard deviation and expected returns for 4 portfolios (A, B, C, and D) are graphed on the following efficient frontier:  Which of the following portfolios are efficient?

Which of the following portfolios are efficient?

Definitions:

Normal Rate

Typically refers to an average or commonly occurring value within a specific context, such as an interest rate or growth rate.

Marginal Cost

The increase or decrease in the total cost that arises when the quantity produced is incremented by one unit.

Fixed Factor

A resource or input whose quantity cannot easily be changed in the short run.

Diminishing Returns

A principle stating that if one factor of production is increased while others are held constant, the output per unit of the variable factor will eventually decrease.

Q1: The expected returns for Securities ABC and

Q3: The primary objective of the financial manager

Q4: A five-year bond paying 8% semi-annual-pay coupons

Q33: Which of the following statements is FALSE?<br>A)Contingent

Q48: Jay writes a call option with a

Q49: Which one of the following is NOT

Q73: What is the expected return for a

Q82: Which of the following is the most

Q115: Min has $5,000 to invest.The expected return

Q129: Michael Porter argues that firms can create