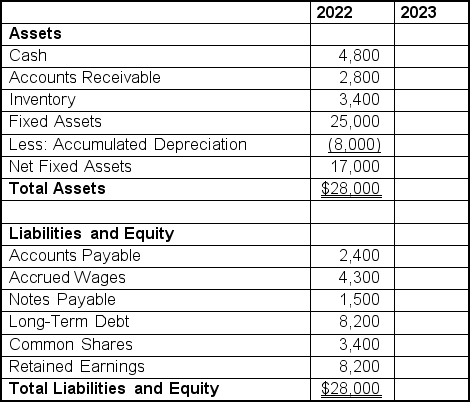

In 2022, Inglis Arctic Sports (IAS)had total sales of $35 million.The firm earned $3.00 per share and paid dividends of $1.00 per share.There are 1 million shares currently outstanding.The 2022 year-end balance sheet is shown below:

Inglis Arctic Sports

Consolidated Balance Sheet

(at year end in thousands of dollars)

You are a financial analyst with IAS and have been asked to prepare a financial plan for next year.You have been given the following information and projections for 2023 from the marketing and production departments:

Sales are projected to grow by 15.0% in 2023.Cash, accounts receivable, accounts payable and wages payable are expected to grow at the same rate as sales.

New capital expenditures will be $3.75 million for the replacement of a production line.

Depreciation expense of $1,200,000 will be recorded in 2023.

The new more efficient production line is expected to result in an inventory increase of only 7.5% from 2022 levels.

Management would like to achieve a total debt-to-equity ratio of 1.0 in 2023, while keeping long-term debt unchanged from 2022.

Management expects the net profit margin and dividend payout ratios to remain the same as in 2022.

Forecast the 2023 balance sheet for IAS.

Definitions:

Q8: Use the following two statements to answer

Q20: Which of the following is true of

Q34: Montreal Financial Services Company offers a perpetuity

Q36: Financial markets are usually classified by the

Q43: The University of Washington's program uses a

Q43: According to the opponent process theory, the

Q54: Macaroni Inc.announced that it would pay the

Q60: After 20 years of being the sole

Q80: The current stock price of Bay James

Q85: Which of the following is NOT a