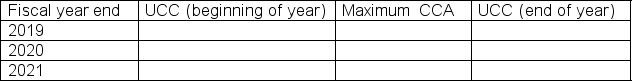

Montreal Smoked Meat Company (MSMC)purchased a machine on February 1, 2019 for $25,000.On October 10, 2019, it purchased another machine for $50,000.Both machines have a CCA rate of 20% and are in the same asset class.These are the only machines in the class and the company has made no asset purchases or sales for the following two years.MSMC's fiscal year end is December 31.Complete the following table (and show your work):

Definitions:

Capital Gain

The profit from selling a capital asset for more than its purchase price.

Dividends

Payments made by a corporation to its shareholders from the earnings of the company, usually in the form of cash or stocks.

Shares

Holdings in a corporation or financial asset, these units confer rights to an equitable distribution of dividends from declared profits.

Quarterly Dividend

A dividend paid by a company to its shareholders every quarter, representing a portion of the company's earnings.

Q12: Establishing firm taboos on drunkenness is one

Q24: According to the 2015 NSDUH survey, more

Q26: Suppose a firm's price/earnings ratio is 10.It

Q33: Assume the following information from the financial

Q42: One advantage of the sociocultural model is

Q43: According to the opponent process theory, the

Q45: prevention is used in the legal system

Q72: Toronto Skaters Company earned a net profit

Q73: Explain the difference between the coupon rate

Q87: The expected returns for Hickory Inc.and Dickory