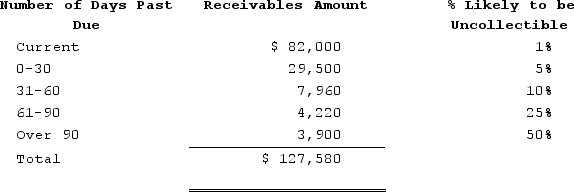

Domino Company ages its accounts receivable to estimate uncollectible accounts expense. Domino began Year 2 with balances in Accounts Receivable and Allowance for Doubtful Accounts of $47,850 and $3,800, respectively. During Year 2, the company wrote off $2,820 in uncollectible accounts. In preparation for the company's estimate of uncollectible accounts expense for Year 2, Domino prepared the following aging schedule:  What amount will be reported as uncollectible accounts expense on the Year 2 income statement?

What amount will be reported as uncollectible accounts expense on the Year 2 income statement?

Definitions:

Balance Sheet Account

An account reported on the balance sheet that includes assets, liabilities, and shareholders' equity at a specific point in time.

Income Statement Account

Accounts that participate in the composition of the income statement, including revenues, expenses, gains, and losses.

Proper Adjustments

Corrections or updates made to financial records to ensure they accurately reflect the company's financial position.

Fiscal Year

A twelve-month period used for accounting purposes and preparing financial statements, which may not align with the calendar year.

Q10: The accountant for Ye Olde Bookstore balanced

Q17: A major thrust of the early Federal

Q18: Indicate how each event affects the financial

Q52: Which of the following produces more economic

Q53: On December 31, Year 1, the West

Q67: Monthly remittance of sales tax due has

Q74: Singleton Company's perpetual inventory records included the

Q120: Elliston Company accepted credit card payments for

Q150: Indicate how each event affects the financial

Q154: Which of the following statements is true