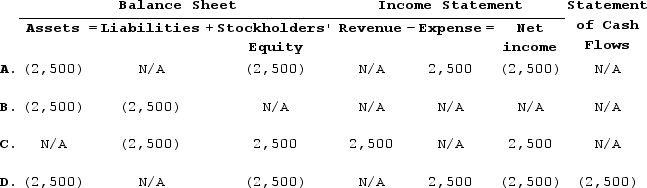

Nelson Corporation is required to record an inventory write-down of $2,500 as a result of using the lower-of-cost-or-market rule. Which of the following shows how this business event would affect the financial statements?

Definitions:

Marginal Benefits

The additional satisfaction or utility gained from consuming or producing one more unit of a good or service.

Proposed Tax

A proposed tax is a tax plan or suggestion that is being considered for implementation but has not yet been enacted.

Recreation Center

A facility intended for recreational activities, sports, and other leisure activities.

Trading of Votes

The exchange of votes among legislators or members of a voting body to ensure mutual support for their respective proposals or interests.

Q10: Wichita, Incorporated reported the following amounts on

Q10: A payment to an employee in settlement

Q13: The following is a partial list of

Q13: The May 31 balance per bank statement

Q26: Knoll Company started Year 2 with a

Q44: A company's amount of cost of goods

Q91: Singleton Company's perpetual inventory records included the

Q98: The inventory records for Radford Company reflected

Q102: Indicate whether each of the following items

Q142: Chase Company uses the perpetual inventory method.