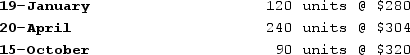

Max Company's first year in operation was Year 1. The following inventory purchase information comes from Max's accounting records for the year:

In December Year 1, Max sold 350 units for $480 each. Operating expenses for the year were $30,000, and the tax rate was 30%.

In December Year 1, Max sold 350 units for $480 each. Operating expenses for the year were $30,000, and the tax rate was 30%.

Required:a)Calculate the cost of goods sold using LIFO.b)Calculate the cost of goods sold using FIFO.c)What amount of income tax would Max have to pay if it uses LIFO?d)What amount of income tax would Max have to pay if it uses FIFO?e)Assuming that the results for Year 2 are representative of what Max can generally expect; would you recommend that the company use LIFO or FIFO? Explain.

Definitions:

Innovative Ideas

Refers to novel or original concepts, methods, or products that can potentially bring about significant improvements or changes.

Sponsorship And Support

Refers to the provision of financial, material, or emotional assistance to individuals or organizations, often to promote specific events, activities, or causes.

Managerial Practices

The methods, strategies, and techniques employed by managers to achieve organizational objectives and manage employee performance.

Human Resource Systems

The organized procedures and frameworks designed to manage an organization's workforce effectively.

Q13: For each of the following transactions, indicate

Q17: Explain the meaning of the fraud triangle

Q18: Indicate how each event affects the elements

Q28: Preparing a bank reconciliation is a control

Q34: Warren Enterprises began operations during Year 1.

Q42: Sometimes the recognition of revenue is accompanied

Q57: During Bruce Company's first year of operations,

Q58: When a company recognizes cost of goods

Q69: The write-off to record the amount of

Q172: Gross margin is reported on a<br>A)single step