Jones Company sells exercise bikes. Its beginning inventory was 100 units at $200 per unit. During the year, Jones made two purchases of the bikes: first, a 300-unit purchase at $220 per unit, and then 200 units at $250 per unit. The ending inventory for the year was 250 units.

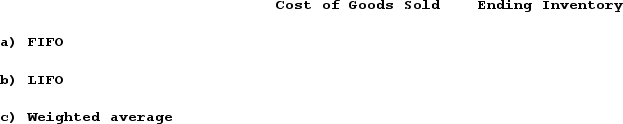

Required:Determine the amount of product costs that would be allocated to cost of goods sold and ending inventory, assuming that Jones uses each of the following inventory cost flow methods:a)FIFOb)LIFOc)Weighted average(Round intermediate calculations to two decimal places. Round final answers to whole dollars.)

Definitions:

Profit-maximizing

The process of adjusting production and operational variables to achieve the highest possible profit margins.

Vertical Distance

The measure of the difference in height between two points, often used in mathematics and geography.

Unit Price

The cost per unit of quantity of a product, allowing consumers to compare prices between different sized packages of the same item.

Competitive Firm

A business that operates in a market where it must compete against other firms for customers and resources.

Q16: The direct write-off method does a better

Q19: The total amount of uncollectible accounts expense

Q35: Glasgow Enterprises started the period with 80

Q38: Why do some say that the GAAP

Q56: A company using a perpetual inventory system

Q69: Indicate how each event affects the elements

Q106: List and explain three of the five

Q125: What happens when a company collects cash

Q158: Warner Company purchased thirty-eight units of a

Q159: Indicate whether each of the following statements