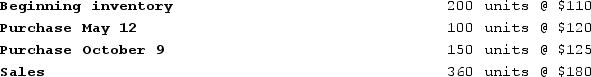

The following information relating to the current year was taken from the records of Poole Company:

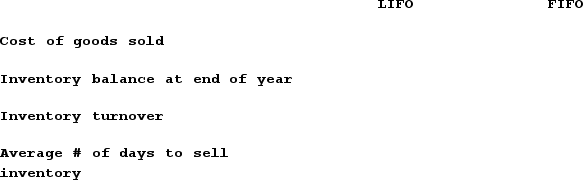

Required:a)Assuming that Poole uses the LIFO cost flow method, determine how much product cost would be allocated to cost of goods sold, and how much to inventory at the end of the year.b)Based on your results from part (a), calculate inventory turnover and average number of days to sell inventory.c)Assuming that Poole uses the FIFO cost flow method, determine how much product cost would be allocated to Cost of Goods sold, and how much to inventory at the end of the year.d)Based on your results from part (c), calculate inventory turnover and average number of days to sell inventory.e)Compare your results from parts (b)and (d). Do LIFO and FIFO give the same results for inventory turnover? Which is higher, and why?

Required:a)Assuming that Poole uses the LIFO cost flow method, determine how much product cost would be allocated to cost of goods sold, and how much to inventory at the end of the year.b)Based on your results from part (a), calculate inventory turnover and average number of days to sell inventory.c)Assuming that Poole uses the FIFO cost flow method, determine how much product cost would be allocated to Cost of Goods sold, and how much to inventory at the end of the year.d)Based on your results from part (c), calculate inventory turnover and average number of days to sell inventory.e)Compare your results from parts (b)and (d). Do LIFO and FIFO give the same results for inventory turnover? Which is higher, and why?

Definitions:

Lifestyle Magazine

A publication focused on sharing content related to personal interests, health, fashion, travel, and culture.

Substandard Article

A written piece that does not meet the expected standards of quality and accuracy.

Constructive Criticism

Feedback given to someone with the aim of helping them improve or develop in a positive manner.

Factual Errors

Mistakes or inaccuracies involving factual information.

Q7: The following information is for Choi Company

Q34: At the end of the Year 2

Q45: Which of the following is a cost

Q47: What is the term used to describe

Q62: Thurston Company started its business on January

Q86: List the specific steps used in computing

Q103: What is (are)the term(s)used to describe a

Q129: What happens when merchandise is delivered FOB

Q133: On January 1, Year 1, the Accounts

Q147: Taylor Company had beginning inventory of $830