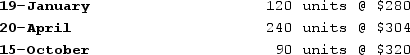

Max Company's first year in operation was Year 1. The following inventory purchase information comes from Max's accounting records for the year:

In December Year 1, Max sold 350 units for $480 each. Operating expenses for the year were $30,000, and the tax rate was 30%.

In December Year 1, Max sold 350 units for $480 each. Operating expenses for the year were $30,000, and the tax rate was 30%.

Required:a)Calculate the cost of goods sold using LIFO.b)Calculate the cost of goods sold using FIFO.c)What amount of income tax would Max have to pay if it uses LIFO?d)What amount of income tax would Max have to pay if it uses FIFO?e)Assuming that the results for Year 2 are representative of what Max can generally expect; would you recommend that the company use LIFO or FIFO? Explain.

Definitions:

Information Communication Technology

Encompasses digital tools and network-based systems that facilitate the capture, processing, and exchange of information.

Polyphasic Activity

Engaging in multiple activities in a short timeline, often overlapping or switching between tasks frequently.

Emotional Competence

The capacity to effectively perceive, express, understand, and manage emotions in oneself and in others.

Policy Manuals

Documents that outline the protocols, rules, and guidelines to be followed within an organization.

Q49: Which of the following is not a

Q57: Galaxy Company sold merchandise costing $2,100 for

Q63: Diaz Company's first year in operation was

Q73: Which of the following statements about the

Q91: Purchasing supplies for cash is an asset

Q93: On January 1, Year 1, Wilson Company

Q99: Assume the perpetual inventory system is used.1)Green

Q129: Thurston Company started its business on January

Q143: Sanchez Company engaged in the following transactions

Q163: What effect will an overstatement of ending