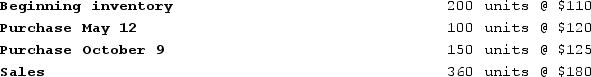

The following information relating to the current year was taken from the records of Poole Company:

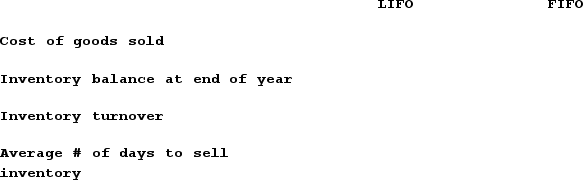

Required:a)Assuming that Poole uses the LIFO cost flow method, determine how much product cost would be allocated to cost of goods sold, and how much to inventory at the end of the year.b)Based on your results from part (a), calculate inventory turnover and average number of days to sell inventory.c)Assuming that Poole uses the FIFO cost flow method, determine how much product cost would be allocated to Cost of Goods sold, and how much to inventory at the end of the year.d)Based on your results from part (c), calculate inventory turnover and average number of days to sell inventory.e)Compare your results from parts (b)and (d). Do LIFO and FIFO give the same results for inventory turnover? Which is higher, and why?

Required:a)Assuming that Poole uses the LIFO cost flow method, determine how much product cost would be allocated to cost of goods sold, and how much to inventory at the end of the year.b)Based on your results from part (a), calculate inventory turnover and average number of days to sell inventory.c)Assuming that Poole uses the FIFO cost flow method, determine how much product cost would be allocated to Cost of Goods sold, and how much to inventory at the end of the year.d)Based on your results from part (c), calculate inventory turnover and average number of days to sell inventory.e)Compare your results from parts (b)and (d). Do LIFO and FIFO give the same results for inventory turnover? Which is higher, and why?

Definitions:

Graduated Exposure

A therapeutic technique where individuals are gradually exposed to their fears to reduce anxiety.

Unconscious Conflicts

Deep-seated tensions and struggles within an individual that they are not fully aware of but influence behaviors and emotions.

Irrational Thinking

Thought processes characterized by illogical or unreasonable conclusions, often leading to negative emotions or behaviors.

Systematic Desensitization

A behavioral therapy technique used to reduce phobic responses and anxiety through gradual exposure to the feared object or situation, combined with relaxation exercises.

Q4: When a company receives payment from a

Q19: The total amount of uncollectible accounts expense

Q30: The following events occurred during a company's

Q102: During Year 2, Oklahoma Trucking Company had

Q108: When the perpetual inventory system is used,

Q110: Depreciation expense is reported on which financial

Q119: How is the accounts receivable turnover computed?

Q167: Blain Company has $20,000 of accounts receivable

Q168: How is a company's operating cycle determined?<br>A)Adding

Q182: Indicate how each event affects the elements