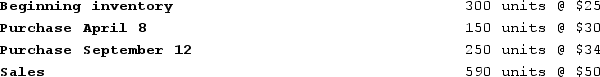

The following information is for Benitez Company for Year 2:

Required:Assuming that Benitez uses the FIFO cost flow method,a)How much product cost would be allocated to cost of goods sold?b)How much product cost would be allocated to inventory at the end of the year?c)Calculate the average number of days to sell inventory for the year.

Required:Assuming that Benitez uses the FIFO cost flow method,a)How much product cost would be allocated to cost of goods sold?b)How much product cost would be allocated to inventory at the end of the year?c)Calculate the average number of days to sell inventory for the year.

Definitions:

Beta

An indicator of how much a stock's price fluctuates compared to the entire market, showing the level of risk associated with its returns.

Standard Deviation

A statistical measure that quantifies the amount of variation or dispersion of a set of values, commonly used in finance to assess the risk associated with a particular investment.

Correlation

Correlation is a statistical measure that describes the extent to which two variables change together, indicating the strength and direction of their relationship.

Market Risk Premium

The additional return investors expect for holding a risky market portfolio instead of risk-free assets, reflecting the extra risk.

Q6: During Bruce Company's first year of operations,

Q22: Which of the following is an example

Q37: Rushmore Company provided services for $45,000 cash

Q68: SX Company sold merchandise on account for

Q79: Requiring segregation of duties in a business

Q122: Tammy Company paid cash to purchase a

Q129: Foster Company's December 31, Year 1, balance

Q132: Sullivan Company uses the periodic inventory system.

Q135: On October 1, Year 1, Wilson Company

Q139: Darlington Company entered into the following business