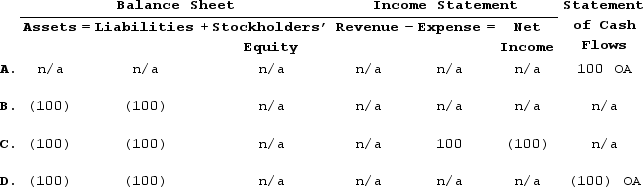

James Company experienced the following events during its first accounting period:(1) Purchased $10,000 of inventory on account.(2) Returned $100 of inventory purchased in Event 1.(3) Sold the inventory for $12,000 cash.Based on this information, which of the following shows how the recognition of the return will affect the Company's financial statements?

Definitions:

Operating Lease

An operating lease is an agreement allowing someone to use an asset without ownership, typically for shorter periods, and expenses are recorded as operating expenses.

Implicit Interest Rate

The interest rate that can be inferred from the terms of a lease or loan, reflecting the true cost of borrowing when the interest rate is not explicitly stated.

Straight-line Method

A depreciation technique that allocates an equal amount of the asset's cost to each year of the asset's useful life.

Depreciation Expense

The allocated cost of an asset over its useful life, representing how much of the asset's value has been used up during an accounting period.

Q21: Hernandez Company began business operations and experienced

Q22: Recognizing an expense may be accompanied by

Q26: If total assets decrease, then<br>A)liabilities must increase

Q67: Which of the following is an asset

Q67: During Year 3, Fancy Foods Incorporated earned

Q104: Which type of accounting information is intended

Q118: Joseph Company purchased a delivery van on

Q130: Which of the following statements regarding the

Q148: Common size financial statements are prepared by

Q165: Hancock Medical Supply Company, earned $160,000 of