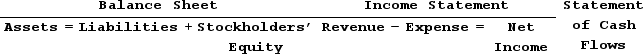

Indicate how each event affects the elements of financial statements. Use the following letters to record your answer in the box shown below each element. You do not need to enter dollar amounts. If an event increases one account and decreases another account equally within the same element (such as an asset exchange event), record I/D. If an event has no impact on the element, record NA.Increase = I Decrease = D Not Affected = NAWetzel Company sold merchandise to a customer for $950 on account. Wetzel's cost of the merchandise was $600. (Consider the effects of both parts of this event.)

Definitions:

Customer Job

A specific project or task undertaken for a customer, often tracked separately for billing and project management purposes.

Expenses

Costs incurred in the process of earning revenue, including operational costs, materials, and services.

FICA

Refers to the Federal Insurance Contributions Act and represents taxes that are deducted to fund Social Security and Medicare programs in the United States.

Federal Income Taxes

Taxes imposed by the government on the annual income of individuals, corporations, trusts, and other legal entities.

Q26: Indicate how each event affects the financial

Q36: Name the group that has the primary

Q41: On February 1, Year 1, Cora Company

Q44: A company's amount of cost of goods

Q47: Purchasing a truck for $50,000 cash with

Q65: The Maryland Corporation was started on January

Q67: Chow Company earned $1,500 of cash revenue,

Q68: SX Company sold merchandise on account for

Q88: In the first year of operation, Ralph's

Q146: Indicate how each event affects the financial