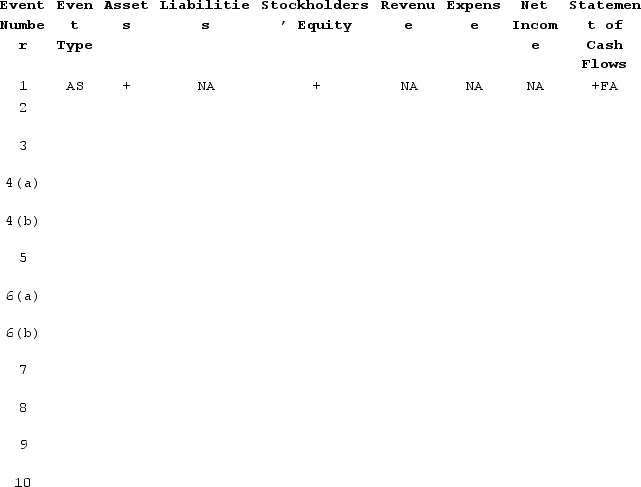

Jackson Medical Supply experienced the following events during June. The company uses the perpetual inventory system.1. Issued common stock for cash.2. Purchased inventory on account, terms 2/10, n/30, FOB shipping point.3. Paid the freight charges on the purchase in event #2.4. Sold merchandise to a customer on account, terms 2/10, n/30, FOB destination.(a)Recognized revenue from sale of merchandise.(b)Recognize cost of goods sold.5. Paid the freight charges on goods sold in event #4.6. Customer returned some of the merchandise sold in event #4.(a)Recognized the sales return.(b)Recognize the cost of the goods as a return to the inventory account.7. Recorded discount granted to the customer in event #4.8. Recorded payment received from the customer in event #4.9. Recorded discount received on purchase in event #2.10. Recorded payment of amount due on purchase in event #2.Required:Complete the financial statements model shown below. Identify each event as asset source (AS), asset use (AU), asset exchange (AX), or claims exchange (CX). Also explain how each event affects the financial statements by placing a "+" for increase, "−"for decrease, "+−" for increase and decrease, or "NA" for not affected under each of the components of the following statements model. Also, indicate in the cash column if the event would be recorded as an operating activity (OA), an investing activity (IA)or a financing activity (FA). The first event is recorded as an example.

Definitions:

Bank Reconciliation

The process of comparing and adjusting a company's book balance of an account with the balance reported by a bank to find any possible discrepancies.

Company's Books

The complete set of financial records of a business, capturing all transactions, accounting entries, and financial statements.

Payment of a Voucher

The process of settling a voucher, which is a document evidencing a transaction and authorizing payment.

Company's Accounts

The financial records that track the financial transactions and the financial position of a company, typically including the balance sheet, income statement, and cash flow statement.

Q8: The dividends a business pays to its

Q29: Is the establishment of a petty cash

Q87: Assume a company paid $1,000 for a

Q101: The historical cost concept requires that most

Q104: Galaxy Company sold merchandise costing $1,700 for

Q108: When the perpetual inventory system is used,

Q110: Leonard Company paid freight costs to have

Q119: Wichita,Incorporated reported the following amounts on its

Q123: The following is a partial set of

Q123: A review of the bank statement and