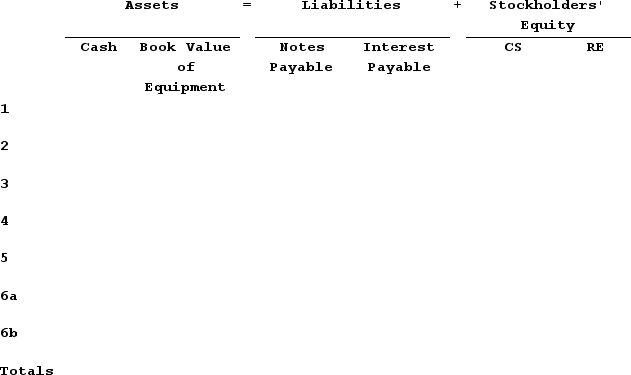

The following events apply to Jason's Lawn Service for Year 1.

1)Issued stock for $14,000 cash2)On January 1, paid $12,000 cash for equipment that has an estimated life of five years and a salvage value of $2,0003)On May 1, issued a $3,000, 5% 3-year note to a local bank4)Performed services of $18,400 and received cash5)Paid $15,000 of operating expenses6a)Adjusted the records to recognize expense associated with use of the equipment during Year 16b)Adjusted the records to recognize interest expense for Year 1Required:Record the effects of the above events under the appropriate account headings in the accounting formula below.

Definitions:

Revenue Recognition Principle

An accounting standard requiring revenue to be recognized in the accounting period when it is earned and measurable.

GAAP

Generally Accepted Accounting Principles; the standard framework of guidelines for financial accounting used in any given jurisdiction, commonly used in the United States.

Business Entity Assumption

An accounting principle that treats a business as a separate legal entity from its owners, requiring separate accounting records.

Personal Financial Information

Data related to an individual's finances, including income, debt, investments, and credit history.

Q29: When are product costs matched directly with

Q30: Selected financial information for Martin Company for

Q36: The effects of transactions occurring during Year

Q44: Glasgow Enterprises started the period with 80

Q46: Indicate how each event affects the elements

Q55: Determine whether each of the following events

Q72: Indicate whether each of the following statements

Q84: When a merchandising company pays cash to

Q85: Packard Company engaged in the following transactions

Q100: Which of the following is not an