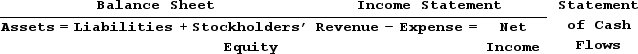

Indicate how each event affects the elements of financial statements. Use the following letters to record your answer in the box shown below each element. If an event increases one account and decreases another account equally within the same element, record I/D. If an event has no impact on the element, record NA. You do not need to enter dollar amounts.

Increase = I Decrease = D Not Affected = NA

Amity Company signed contracts for $25,000 of services to be performed in the future.

Definitions:

Accounts

Financial records of transactions that track the income, expenses, assets, liabilities, and equity of an entity.

Double-Entry System

An accounting method that records each transaction in at least two accounts, ensuring the accounting equation (Assets = Liabilities + Equity) remains balanced.

Debit Accounts

Accounts that are increased by debits and decreased by credits, commonly including assets and expenses.

Credit Accounts

Financial accounts that track money owed to creditors; they increase with credit entries and decrease with debit entries, reflecting the entity's borrowing of funds.

Q3: Short-term creditors are usually most interested in

Q4: Sales discounts do not affect a company's

Q8: Accrual accounting usually fails to match expenses

Q15: Name and briefly describe each of the

Q41: Exeter Company sold merchandise for $10,000 cash.

Q56: Debits decrease asset accounts.

Q91: A liability account normally has a credit

Q108: Starwood Corporation has current assets of $200,000,

Q142: A trial balance can only be prepared

Q166: Yowell Company began operations on January 1,