The following business events occurred for Ringgold Company during Year 1, its first year in operation:

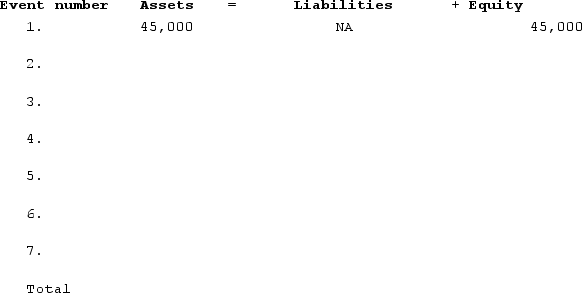

1. Issued stock to investors for $45,000 cash2. Borrowed $25,000 cash from the local bank3. Provided services to its customers and received $32,000 cash4. Paid expenses of $28,0005. Paid $22,000 cash for land6. Paid dividend of $12,000 to stockholders7. Repaid $10,000 of the loan listed in item 2

Required:a)Show the effects of the above transactions on the accounting equation, below. Include dollar amounts of increases and decreases. Enter "NA" for elements of the accounting equation that are not affected by the transaction. If one element of the accounting equation is affected by an increase and also by a decrease, enter each part on a separate line (i.e. asset exchange transaction where one asset increases and another asset decreases). (The effects of the first transaction is shown below.)b)After entering all the events, calculate the total amounts of assets, liabilities, and equity at the end of the year.

Definitions:

Comprehensive Income

The change in equity of a business enterprise during a period from transactions and other events from non-owner sources. It includes all forms of earnings and gains or losses.

Accounts Payable Turnover

A financial metric that measures the rate at which a company pays off its suppliers.

Days' Sales

A financial metric that measures the average time it takes for a company to turn its inventory into sales.

Receivables

Money owed to a company by its customers from sales or services rendered, recorded as an asset on the balance sheet.

Q3: Indicate how each event affects the elements

Q6: Jack Henry borrowed $800,000 from Walt Bank

Q21: The trial balance of Barger Company at

Q55: Retained earnings at the beginning and ending

Q56: At the end of Year 1, the

Q112: A company may recognize a revenue or

Q119: Discuss the major differences between a perpetual

Q120: Chester Company started Year 2 with a

Q132: Earnings before interest and taxes divided by

Q135: Peterson Corporation recorded an adjusting entry using