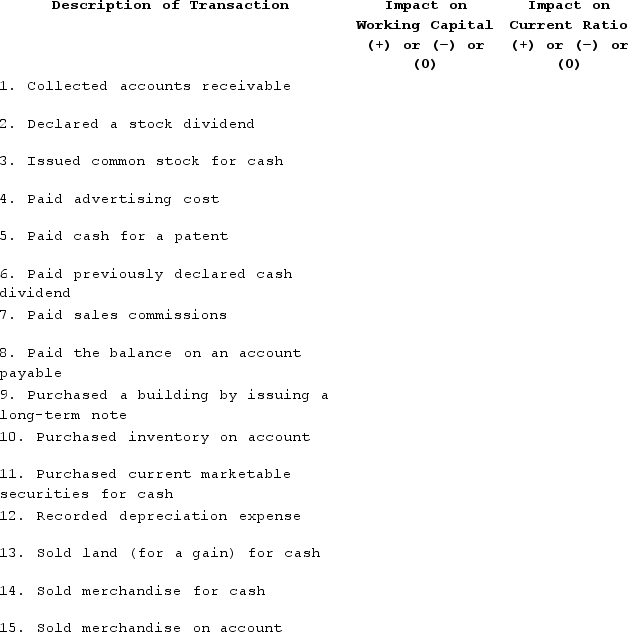

Many companies have to monitor some of their financial statement ratios, such as the current ratio, due to debt covenants. Selected transactions are provided below for a company that uses a perpetual inventory system; sells its merchandise at a selling price that exceeds cost; and had a current ratio of 1.85 to 1 before the event occurred.

Required:

Required:

In the above table, indicate whether each transaction would increase (+), decrease (−), or not affect (0)the company's working capital and the current ratio.

Definitions:

Stocks

Shares of ownership in a company, representing a claim on the company's earnings and assets.

Bonds

Fixed-income instruments that represent a loan made by an investor to a borrower, usually corporate or governmental, which pays back the face value at maturity, along with regular interest payments.

Mutual Funds

Investment programs funded by shareholders that trade in diversified holdings and are professionally managed.

Credit Card Debt

A type of unsecured liability which accrues when a consumer purchases goods or services with a credit card and fails to pay back the borrowed amount within the stipulated period.

Q18: Which of the following cash transactions is

Q19: Treasury Stock is reported on the balance

Q28: The primary difference between notes payable and

Q55: Retained earnings at the beginning and ending

Q65: Chisholm Associates uses the indirect method to

Q66: In which section of a statement of

Q71: Indicate how each event affects thefinancial statements.

Q122: Revenue on account amounted to $5,600. Cash

Q123: Assume that a company recorded the following

Q155: Consider each of the following accounting events:<br>1)Debited