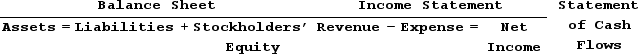

Indicate how each event affects the financial statements. Use the following letters to record your answer in the box shown below. If an event increases one account and decreases another account equally within the same element, record I/D. If an event has no impact on the element, record NA. You do not need to enter amounts.

Increase = I Decrease = DNot Affected = NA

A transaction recorded as a debit to Cash and a credit to Unearned Revenue.

Definitions:

Wages and Salaries Payable

Liabilities for wages and salaries that have been earned by employees but have not yet been paid.

Federal Income Taxes Payable

The amount of income tax that a company or individual owes to the federal government and has not yet paid.

Payroll Taxes Payable

Liabilities owed to tax authorities for employee taxes withheld and employer payroll taxes; to be paid within a specified period.

FUTA Payable

A liability account reflecting the federal unemployment tax due to the government by employers.

Q11: Fixit Corporation issued 20,000 shares of $20

Q14: Which of the following is the most

Q48: Grimes Corporation reports the following cash transactions

Q62: Select the correct statement regarding vertical analysis.<br>A)Vertical

Q70: On January 1, Year 1, the organizers

Q73: Indicate how each event affects the financial

Q81: As of December 31, Year 1, Gant

Q86: Which of the following transactions is a

Q128: Grace Company sold equipment for $40,000 cash.

Q151: Why would some bonds be classified as