Consider the following situations that require adjustments for Anaheim Company at December 31, Year 1:

1)Owed salary expenses totaling $10,500 that will be paid during January of Year 22)The supplies account has a balance of $2,400 and a physical count of the supplies revealed that $660 of unused supplies were available for future use3)On October 1, Year 1, the company had collected an advance payment from a customer for $96,000 for services to be rendered equally over the six-month period beginning on that date.

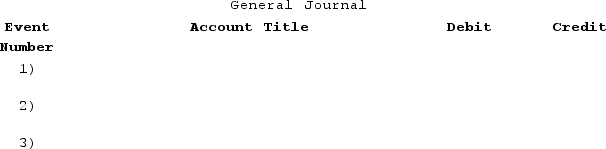

Required:Record the adjusting entry required for each of the situations described above.

Definitions:

Real Wages

Wages adjusted for inflation, reflecting the purchasing power of income.

Minimum Wage

The lowest legal hourly pay for many workers, set by law or policy.

Secondary Labor Market

Employment sectors characterized by low pay, insecure job tenure, and poor working conditions.

Wage Rate

The fixed amount of compensation or payment a worker receives from the employer in exchange for labor or services, typically expressed per hour or year.

Q5: Which of the following is a disadvantage

Q15: Name and briefly describe each of the

Q24: What is the purpose of the statement

Q50: Indicate whether each of the following statements

Q55: Retained earnings at the beginning and ending

Q56: The stock market crash in 1929 led

Q75: When using the indirect method to complete

Q106: Which of the following statements is true

Q139: Weymouth Company uses the indirect method to

Q152: Miller Company reported gross sales of $850,000,