Phelps Company entered into the following transactions during Year 1:

1)Provided services to customers for cash, $70,0002)Purchased land by paying cash, $32,0003)Paid rent in advance for 6 months, $24,0004)Acquired cash of $50,000 by issuing common stock5)Purchased supplies on account, $5,4006)Receive payment of $6,000 from a customer for services that will be provided over the next six months.

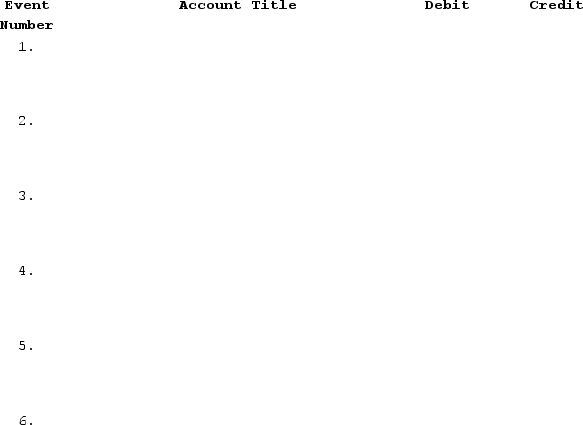

Required:a)Prepare journal entries for each of the preceding transactions.

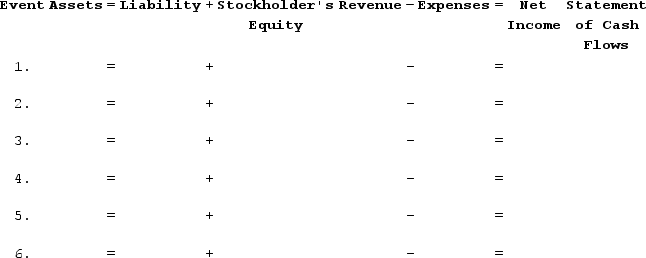

b)Show how each transaction affects the financial statements by inserting the related dollar amounts. Precede each amount with a plus sign ("+")if the transaction increases, a minus sign ("−")if the transaction decreases, or "NA" if the transaction does not affect a given element of the financial statements.In the last column, use the letters "OA" for operating activities, "IA" for investing activities, and "FA" for financing activities, or "NA" if the statement of cash flows is not affected.

b)Show how each transaction affects the financial statements by inserting the related dollar amounts. Precede each amount with a plus sign ("+")if the transaction increases, a minus sign ("−")if the transaction decreases, or "NA" if the transaction does not affect a given element of the financial statements.In the last column, use the letters "OA" for operating activities, "IA" for investing activities, and "FA" for financing activities, or "NA" if the statement of cash flows is not affected.

Definitions:

Reducing Inflation

Measures and policies implemented to decrease the rate at which the general level of prices for goods and services is rising.

Debt-to-Income Ratio

A financial measure that compares an individual's total debt to their total gross income, often used by lenders to assess borrowing risk.

Inflation Rate

The rate at which the general level of prices for goods and services is rising, eroding purchasing power.

Real Growth Rate

The rate at which an economy's gross domestic product (GDP) grows after adjusting for inflation, indicating the actual growth of economic output.

Q3: Indicate how each event affects thefinancial statements.

Q9: What is meant by the term "double

Q18: Indicate whether each of the following statements

Q24: To record an asset source transaction, an

Q26: Indicate whether each of the following statements

Q33: On January 1, Year 1, Victor Company

Q69: Indicate how each event affects the financial

Q119: If a corporation issues common stock for

Q139: Indicate whether each of the following statements

Q144: Erie Company reports the following comparative balance