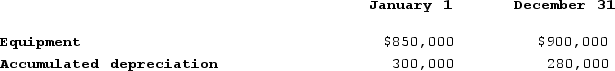

Preston Corporation uses the indirect method to prepare the cash flow from operating activities section of the statement of cash flows. The company had the following beginning and ending balances for Year 2:

During Year 2, Preston sold equipment for $60,000 that had originally been purchased for $140,000. The old equipment had accumulated depreciation of $120,000 at the time of sale. To replace the equipment, Preston purchased new equipment by making a $30,000 down payment and signing a two-year note for the balance due of $160,000.

During Year 2, Preston sold equipment for $60,000 that had originally been purchased for $140,000. The old equipment had accumulated depreciation of $120,000 at the time of sale. To replace the equipment, Preston purchased new equipment by making a $30,000 down payment and signing a two-year note for the balance due of $160,000.

Required:a)What was the cost of the new equipment purchased during the year?b)What is the gain or loss on the sale of the old equipment?c)How will the gain or loss be reported on the statement of cash flows?d)How will the sale of the equipment be reported in the cash flow from investing activities section of the statement of cash flows?e)How will the purchase of equipment be reported in the cash flow from investing activities section of the statement of cash flows?f)How will the issuance of the two-year note be reported on the statement of cash flows?

Definitions:

Liberalism

A school of thought advocating for personal liberty, the consent of those under governance, and fairness within the legal system.

Government Property

Assets owned by the state or government, including buildings, land, and resources.

Economic Assistance

Financial aid provided by governments or international institutions to support the economies of other nations, communities, or individuals in need.

Progressive Tax

A tax for which high-income taxpayers pay a larger fraction of their income than do low-income taxpayers.

Q20: Which of the following statements about financial

Q25: Which of the following would not be

Q37: Johansen Company issued a bond at a

Q39: At the beginning of Year 2, Griggs

Q63: Which of the following statements about installment

Q64: On January 1, Year 1, Wayne Company

Q73: A corporation might buy some of its

Q92: During Year 1, El Paso Company had

Q113: Indicate how each event affects thefinancial statements.

Q121: Which of the following statements best explains