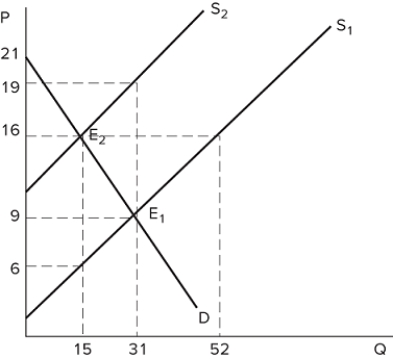

Suppose a tax on sellers has been imposed in the market shown in the graph. What is the total tax paid per unit of the good?

Suppose a tax on sellers has been imposed in the market shown in the graph. What is the total tax paid per unit of the good?

Definitions:

Fixed Costs

Costs that do not change in total amount with a change in business activity level, such as rent or salaries.

Short Run

The short run in economics is a period during which at least one input, like plant size, is fixed and cannot be changed.

Monopolistically Competitive

A market structure where many firms sell products that are similar but not identical, allowing for some degree of market power and price setting.

Fixed Costs

Expenses that do not vary with the level of production or sales, such as rent or salaries.

Q22: "Do unto others as you would have

Q32: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8422/.jpg" alt=" If a price

Q49: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8422/.jpg" alt=" The figure shown

Q65: When your outcomes depend on another's choices,

Q68: If the price of a cup of

Q72: In a _ economy, private individuals (as

Q95: Christopher just won tickets to see an

Q116: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8422/.jpg" alt=" According to the

Q130: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8422/.jpg" alt=" The figure shown

Q143: Jan heads to the store to buy