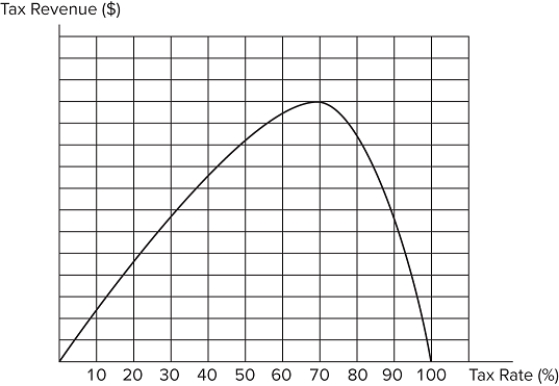

Consider the Laffer curve for a hypothetical good as displayed in the graph shown.  Suppose the current tax rate is 45 percent. This implies that: the price effect currently outweighs the quantity effect.the government could increase revenue by lowering the tax rate.the current tax rate is efficient.

Suppose the current tax rate is 45 percent. This implies that: the price effect currently outweighs the quantity effect.the government could increase revenue by lowering the tax rate.the current tax rate is efficient.

Definitions:

Absorption Costing

A pricing strategy that encompasses all expenses associated with production, including direct materials, direct labor, as well as both variable and fixed overhead costs, in the product's price.

Operating Income

A measure of a company's profitability from its core business operations, excluding revenue and expenses from non-operational activities.

Variable Costing

A costing method that includes only variable production costs (direct materials, direct labor, and variable manufacturing overhead) in product costs, excluding fixed manufacturing overhead.

Operating Income

Earnings generated from a company's standard business operations, excluding income from investments and other non-operational sources.

Q19: When there are significant costs involved with

Q48: Means-tested government programs:<br>A)require recipients to undergo skills

Q52: Suppose an American worker can make 20

Q58: Commitment devices are:<br>A)methods to increase the price

Q65: Compared to two-party systems, proportional-representation systems are

Q67: Which of the following is a public

Q70: You read a news article that states

Q77: What tool can a government use to

Q100: When a good is undersupplied, we can

Q120: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8422/.jpg" alt=" Refer to the