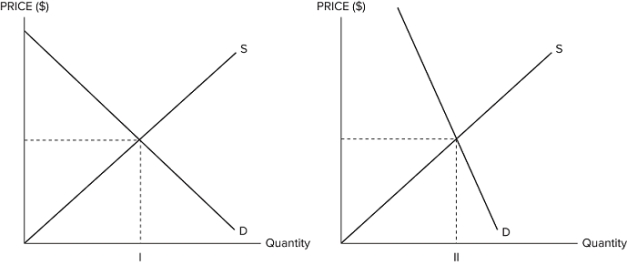

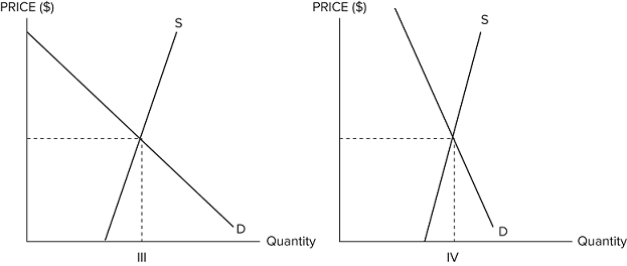

Suppose the government is considering imposing a tax in one of the markets shown in graphs I, II, III, and IV.  <p><b><span style="font-size:20pt;"><span style="color:#FF0000;">

<p><b><span style="font-size:20pt;"><span style="color:#FF0000;">

If the government's goal is to raise as much revenue as possible while minimizing deadweight loss, it should impose the tax in the market in which graph?

Definitions:

Net Income

Total income of the company after expenses, taxes, and any other costs are deducted from its revenue.

Preferred Dividends

Dividends that are paid to preferred shareholders at a fixed rate before any dividends are paid to common shareholders.

Earnings Per Share

A measure of a company's profitability calculated by dividing net income by the number of outstanding shares of its common stock.

Net Income

The total profit of a company after all expenses, including taxes and operating expenses, have been deducted from total revenue.

Q5: The _ the Lorenz curve lies from

Q28: The free rider problem is caused by

Q31: Suppose Bob earns $20,000 per year and

Q42: External costs and external benefits are collectively

Q59: Since the 1950s, the U.S. poverty rate

Q75: If the government were to restrict consumption

Q78: The table shown displays voters' preferences in

Q90: Which of the following is an example

Q95: Excludability is important because it:<br>A)allows sellers to

Q132: Suppose an American worker can make 50